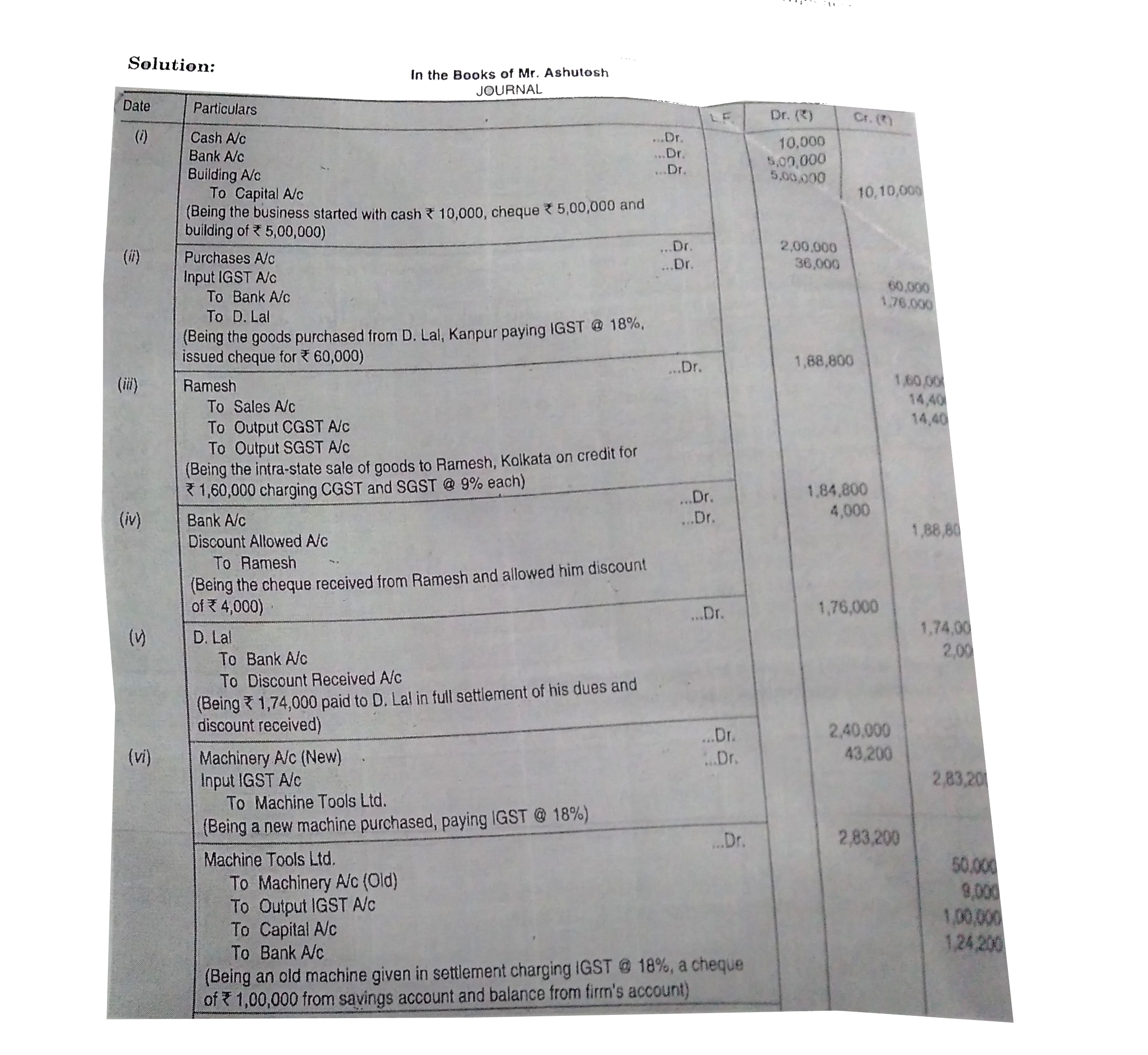

Journalise the following transactions in the books of Ashutosh, Kolkata: (i) He started business contributing Rs. 10, 000 in cash, Rs. 5,00,000 in cheque and a building valued at Rs. 5,00,000. (ii)

PSA L&P - Journal Entries: How to record a deposit to or a withdrawal from a savings account, or an electronic funds transfer between bank accounts – ParishSOFT

![Solved Problem 13-1 Bank loan; accrued interest L013-2] | Chegg.com Solved Problem 13-1 Bank loan; accrued interest L013-2] | Chegg.com](https://media.cheggcdn.com/media%2Fe78%2Fe7831288-5e8c-4d82-bbb3-67f2d80a53f4%2FphpymGjxB.png)