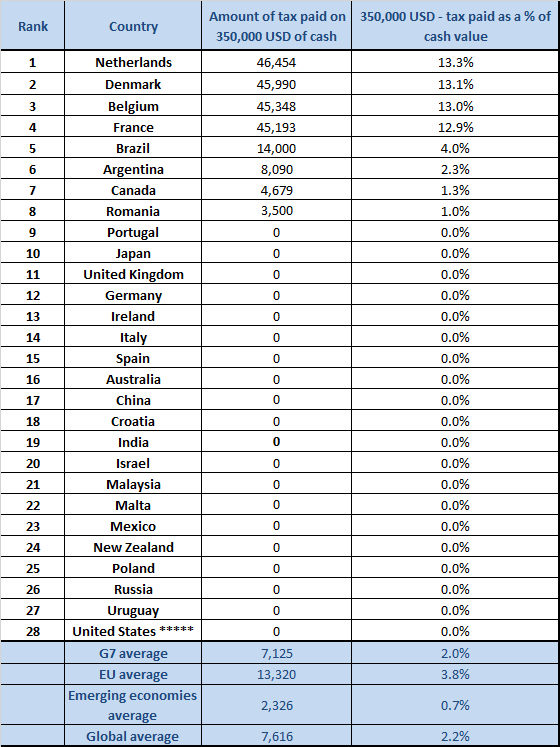

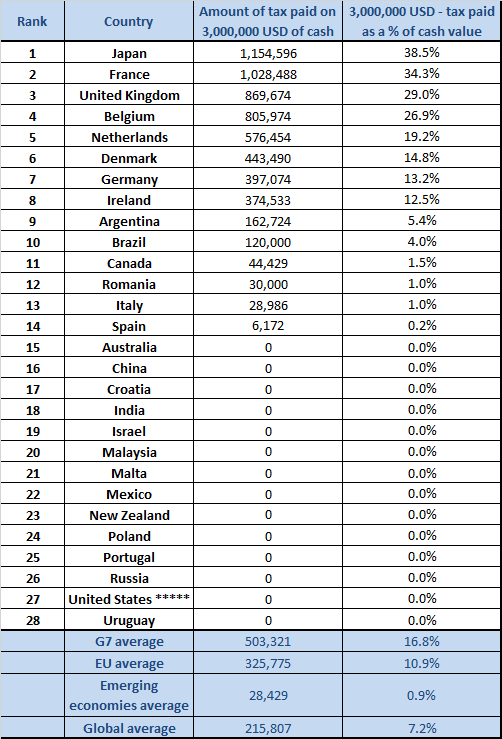

Inheritance Tax rates in G7 and EU countries ten times higher than emerging economies - UHY InternationalUHY International

Inheritance Tax rates in G7 and EU countries ten times higher than emerging economies - UHY InternationalUHY International